Building financial literacy.

Author: Tim O’Connor | Author Title: Secondary Humanities Teacher SGSD | Publication Date: September 2024

In today’s complex economic landscape, where trends and information are rapidly evolving, financial literacy has become more crucial than ever. With markets constantly shifting and an abundance of data at our fingertips, understanding how to manage money, make informed investment decisions, and navigate fiscal challenges is essential for personal and professional success.

At St.George’s, we pride ourselves on providing a well-rounded education that prepares students for the complexities of the modern world. While traditional subjects like Mathematics, the sciences, and literature are essential, there's another critical area of knowledge that often goes untaught in schools: personal finance and investment. Understanding how to manage money, make informed financial decisions, and invest wisely are life skills that every adult needs but are rarely part of the standard curriculum.

Personal finance and investment club

Our school addresses this gap by enhancing the humanities coursework with a finance and investment club, allowing students to further deepen their financial knowledge and skills. This extracurricular initiative offers them opportunities to expand their understanding of financial concepts and investment strategies.

The inspiration

Financial literacy goes beyond personal money management; it is intrinsically linked to a broader understanding of economic markets. During my time working in South Africa, I had the opportunity to witness the positive impact of a compulsory three-year subject that introduces students to entrepreneurship, finance, and economics. This highlighted the invaluable benefits of early financial education. By grasping the principles of finance, students gain insights into how economic systems function, the role of financial institutions, and the impact of economic policies on individual and business finances. This knowledge helps them understand market trends, investment opportunities, and the effects of economic fluctuations, which are essential for making informed decisions in a dynamic financial landscape.

"An investment in knowledge pays the best interest."

Benjamin Franklin

The goals of the programme

The primary goal of the personal finance and investment club is to foster financial literacy among students by providing them with a comprehensive understanding of personal finance and investment options. The programme seeks to demystify the world of finance, breaking down complex concepts into accessible language and lessons that students can apply in their daily lives.

Through interactive sessions and practical activities that enhance the curricular coursework with the club projects, we aim to bridge the gap between personal finance and economic market understanding. Students learn about money management, saving, and investing and acquire the skills needed to make sound financial decisions, comprehend economic trends, and apply financial knowledge in diverse settings. They not only learn how to manage their personal finances but also develop a foundational understanding of economic markets and professional financial practices. This dual approach prepares them to handle financial responsibilities in both their personal lives and future careers.

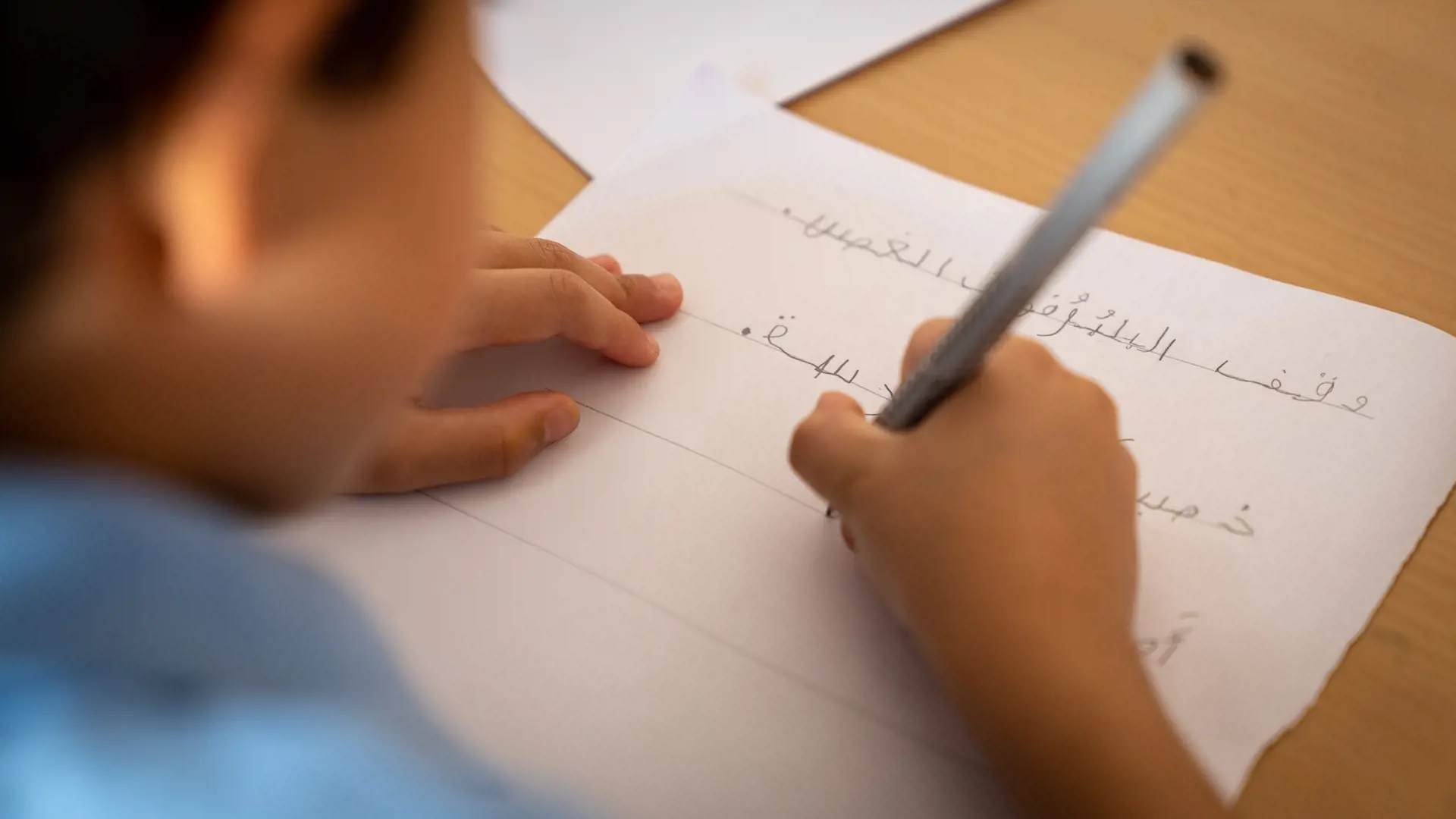

Introduction to personal finance

The club's journey begins with a fundamental understanding of personal finance. Students are introduced to the concept of money - what it is, how it functions in society, and the importance of managing it wisely.

Investing basics

Once students have a grasp of personal finance, we delve into the world of investing. Investing is a powerful tool for building wealth, but it is often misunderstood or seen as too complex for young people. Our club breaks down these barriers by introducing students to the basics of investing, explaining how it differs from saving, and why it is important for long-term financial security.

We explore various investment vehicles, including stocks, bonds, mutual funds, ETFs, and real estate, providing students with a broad understanding of their options. A key focus is on the concept of risk and return, helping students understand the relationship between the potential rewards of an investment and the risks involved. We also cover compound interest, a powerful concept that demonstrates how investments can grow exponentially over time when managed wisely.

Stock market basics

The deep dive into the stock market is one of the most thrilling aspects of the club. Our goal is to make it accessible and engaging for students. We start by explaining how the stock market works, covering the basics of stock exchanges, how stocks are bought and sold, and the factors that influence stock prices.

Students learn to read stock quotes, understand ticker symbols, and interpret market trends. We also introduce them to major stock market indices, such as the S&P 500 and Dow Jones, and discuss their significance in the broader economic landscape. Finally, we teach students the basics of investing in stocks, ETFs, and index funds, providing them with the knowledge they need to start their own investment journeys.

Trading with a demo account

One of the most effective ways to learn about investing is through hands-on experience. To facilitate this, we provide students with the opportunity to trade with a demo account. This allows them to research and trade stocks and ETFs in a risk-free environment, gaining practical experience without the fear of losing real money.

The practice account trading sessions are always a highlight for our students, allowing them to apply the knowledge they've gained in a simulated market, and make investment decisions based on research and analysis. This experience helps to reinforce the lessons learned in the club and provides students with a deeper understanding of how the stock market operates.

The personal finance and investment club at St.George’s is more than just an extracurricular activity; it is a vital part of preparing students for the challenges and opportunities of adult life. By providing a solid foundation in personal finance and investment, we empower students to take control of their financial futures, make informed decisions, and build a secure financial foundation for themselves. We want our students to not only be academically successful but also financially savvy, capable of navigating the financial challenges of the modern world with confidence and competence.